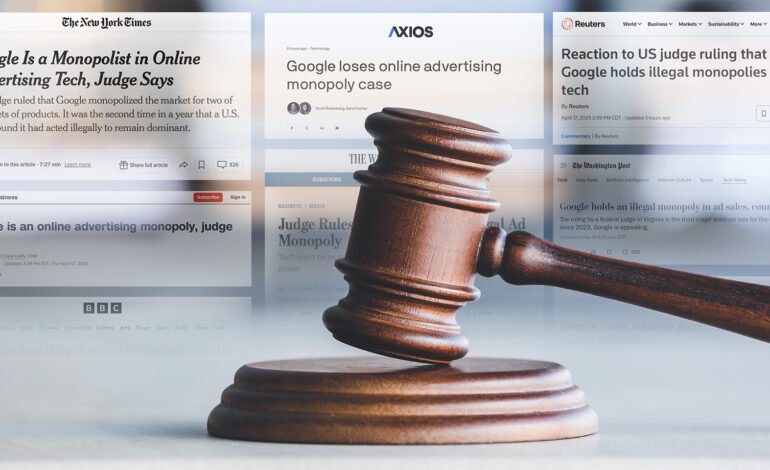

Google’s Ad Tech Empire Under Fire: Judge Rules Against Monopoly Tactics

Google’s Ad Tech Empire Under Fire: Judge Rules Against Monopoly Tactics

In a landmark ruling that’s sending shockwaves through the digital advertising ecosystem, a federal judge has found that Google illegally monopolized the ad tech market. This decision is poised to reshape the digital advertising landscape, potentially bringing long-awaited reforms and opening doors for competitors.

The case, brought forward by the U.S. Department of Justice and joined by several state attorneys general, accused Google of engaging in anti-competitive practices that stifled innovation, drove up ad costs, and harmed publishers and advertisers alike.

What the Ruling Means

The judge’s decision underscores that Google leveraged its dominance in digital advertising to unfairly control the supply chain — from advertisers to publishers — and suppressed competition by using exclusionary tactics.

According to the court findings, Google not only owns the largest ad exchange (AdX) but also operates tools that advertisers and publishers rely on. This vertical integration gave Google the power to manipulate auctions, favor its own platforms, and undermine rivals.

How Google Built Its Ad Tech Monopoly

The ruling highlighted several core practices Google employed to maintain its grip on the industry:

- Acquisitions of Competitors

Google strategically acquired platforms like DoubleClick and AdMeld, eliminating competition and consolidating power in one ecosystem. - Preferential Treatment

Google allegedly manipulated ad auctions to give preference to its own demand and supply platforms, essentially ensuring advertisers paid more while publishers earned less. - Restricted Data Access

By limiting access to key ad performance data, Google made it harder for publishers and advertisers to track effectiveness or consider alternative platforms. - Blocking Competitor Access

Google reportedly imposed rules that restricted the use of competing ad tech tools in tandem with its own, creating a walled garden environment.

Industry Implications

This ruling could drastically alter how digital advertising works, and several key implications are already coming into focus:

- More Transparency

Advertisers and publishers could benefit from a more transparent bidding process and fairer pricing as regulatory scrutiny intensifies. - Increased Competition

The judgment opens the door for smaller ad tech firms and new players to enter the market, providing more choices and better innovation. - Revised Business Practices

Google may be forced to divest certain ad tech assets or restructure how its platforms operate to comply with antitrust laws. - Better ROI for Advertisers

With less market manipulation, businesses investing in digital ads may see improved returns on ad spend.

Reactions from the Ad Industry

Industry stakeholders have largely welcomed the ruling, describing it as a long-overdue step toward leveling the playing field. Independent ad tech companies have expressed hope that the judgment will usher in an era of more equitable practices.

Publishers especially smaller and independent ones also stand to benefit. For years, many have argued that Google’s monopoly eroded their ad revenues through unfair auction processes and revenue-sharing models.

Meanwhile, privacy advocates are calling for additional oversight, warning that market dominance and user data exploitation often go hand-in-hand.

What’s Next for Google?

While Google is expected to appeal the decision, the tech giant is now under immense regulatory pressure. In similar global cases such as those in the EU and Australia regulators have already moved to fine or restrict Google’s ad operations.

If the ruling stands, Google may need to:

- Separate its ad exchange from its demand/supply-side platforms

- Cease bundling ad services that limit competition

- Increase data transparency and access for all stakeholders

These changes, though potentially painful for Google in the short term, may restore trust and accountability across the digital advertising ecosystem.

What Advertisers and Marketers Should Do

As this case evolves, marketers and advertisers should:

- Explore Alternatives: Begin testing other DSPs (Demand-Side Platforms) and SSPs (Supply-Side Platforms) to diversify ad buying strategies.

- Focus on First-Party Data: With increasing scrutiny on ad tracking and data privacy, build stronger first-party data strategies.

- Stay Informed: Track updates from the DOJ and tech news sources to remain prepared for further industry changes.

- Review Contracts: Reassess contracts and partnerships with ad tech vendors, ensuring there are no restrictive clauses tied to Google’s ecosystem.

Conclusion

The judge’s ruling that Google illegally monopolized the ad tech market is a monumental development not just for the tech world, but for everyone involved in digital advertising. The ripple effects of this decision will be felt for years, redefining the rules of engagement and possibly marking the beginning of a fairer, more open internet economy.

Whether you’re a marketer, publisher, or tech enthusiast, now is the time to adapt, innovate, and prepare for a post-monopoly digital future.

1 Comment

The website design looks great—clean, user-friendly, and visually appealing! It definitely has the potential to attract more visitors. Maybe adding even more engaging content (like interactive posts, videos, or expert insights) could take it to the next level. Keep up the good work!